2025 Labour Code Shock: Lower Salary, Bigger PF?

You open your payslip this month and notice something different. Moreover, your HR team sends an email about salary restructuring under the new labour codes. Furthermore, you wonder if your monthly take-home pay will shrink while your retirement savings grow bigger. Additionally, this exact scenario now plays out for millions of employees across India since the four new labour codes came into effect on November 21, 2025.

The government consolidates 29 old labour laws into four modern codes. These include the Code on Wages 2019, the Code on Social Security 2020, the Industrial Relations Code 2020, and the Occupational Safety, Health and Working Conditions Code 2020. Moreover, the biggest change that directly affects your wallet comes from a uniform definition of “wages.” This definition forces companies to restructure salaries in a way that boosts provident fund (PF) contributions and gratuity payouts. However, it often reduces your immediate in-hand salary if your total cost to company (CTC) stays the same.

You deserve to understand exactly what the law says and how it impacts you. Therefore, this blog breaks it down step by step with real examples, calculations, and practical tips.

First, What Exactly Do the New Codes Say About "Wages"?

The Code on Wages 2019 and the Code on Social Security 2020 introduce a single, clear definition of wages that applies everywhere. Previously, different laws used different definitions, which created confusion and allowed companies to keep basic pay low.

The law now defines wages as all remuneration that includes:

- Basic pay

- Dearness allowance (DA)

- Retaining allowance (if your job provides one, common in some industries like sugar mills)

However, wages exclude certain items. These exclusions cover bonus, house rent allowance (HRA), conveyance allowance, overtime pay, commissions, employer PF contributions, gratuity, and retrenchment compensation.

Most importantly, the law adds a crucial 50 percent rule. Excluded components (all allowances together) cannot exceed 50 percent of your total remuneration or CTC. If they do exceed 50 percent, the excess amount counts as wages for calculating benefits like PF and gratuity.

In simple English, the government ensures that at least 50 percent of your total pay counts as the core “wages” component. Companies can no longer load your salary with huge allowances to minimize statutory contributions. As a result, basic pay plus DA effectively rises to at least 50 percent for most employees.

Next, Why Does This Make PF Contributions Skyrocket?

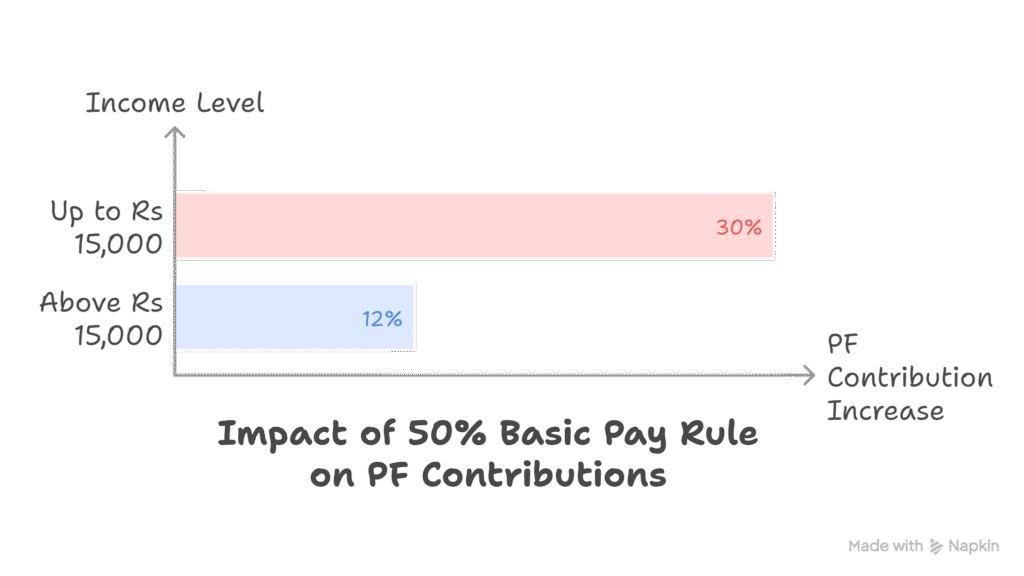

Employees and employers both contribute 12 percent of wages to the Employees’ Provident Fund (EPF). Previously, many companies kept basic pay at 30 to 40 percent of CTC and put the rest in allowances. This practice kept PF deductions low.

Now, with the 50 percent rule, the base for PF calculation increases. Both you and your employer pay more into your PF account each month.

Moreover, for employees earning up to Rs 15,000 per month, this change hits harder because PF applies to the full amount without any cap. For higher earners, employer PF often caps at 12 percent of Rs 15,000, but your own contribution rises if basic pay goes up.

Furthermore, higher PF means more money compounds over time with interest (currently around 8 to 8.5 percent per year). This builds a much stronger retirement corpus.

Additionally, How Does Gratuity Get a Massive Boost?

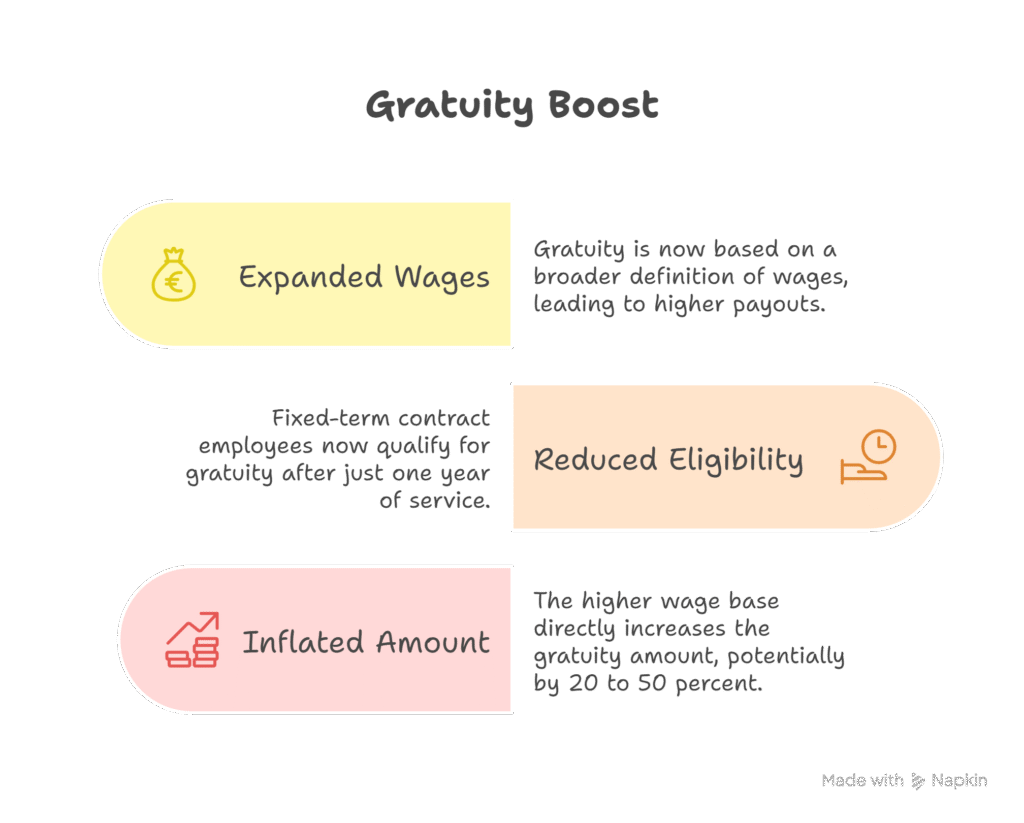

Gratuity is the lump-sum amount your employer pays when you leave after completing the eligibility period. The formula calculates it as (last drawn wages × 15 days) × number of years served, divided by 26.

Under the new codes, gratuity bases on the same expanded “wages” definition. Since wages now form at least 50 percent of CTC, your final gratuity payout becomes significantly higher.

For example, fixed-term contract employees now qualify for pro-rata gratuity even after just one year of service. Previously, everyone needed five continuous years.

In addition, the higher wage base directly inflates the amount. Experts estimate gratuity could rise by 20 to 50 percent or more, depending on your previous salary structure.

So, Will Your Take-Home Salary Actually Drop?

Yes, for many employees, it will drop in the short term if your employer keeps the overall CTC unchanged. Companies shift money from flexible allowances (which you received in hand) into the higher basic pay. This higher basic pay then goes partly to increased PF deductions.

However, this shift does not reduce your total earnings. It simply redirects more money into forced long-term savings.

Moreover, some companies absorb the extra employer PF cost or restructure allowances creatively to minimize the dip. Others increase CTC slightly to offset the impact.

Furthermore, lower earners (below Rs 15,000 monthly) feel the biggest monthly pinch because PF rises fully on the increased base.

Let Us Look at Real Numbers to Make This Crystal Clear

Suppose your annual CTC is Rs 10 lakh (about Rs 83,333 monthly).

Old Structure (Common Before November 2025):

- Basic pay: 40 percent = Rs 4 lakh per year (Rs 33,333/month)

- Allowances (HRA, special, etc.): 60 percent = Rs 6 lakh

- Your PF contribution (12 percent of basic): Rs 4,000/month

- Take-home (after PF and taxes, roughly): Around Rs 65,000 to 70,000/month

New Structure (After 50 Percent Rule):

Companies raise basic to at least 50 percent = Rs 5 lakh per year (Rs 41,667/month). They reduce allowances to Rs 5 lakh.

- Your PF contribution now: 12 percent of Rs 41,667 = Rs 5,000/month

- Extra deduction: Rs 1,000/month (Rs 12,000/year)

- Take-home drops by about Rs 800 to 1,200/month after taxes

Meanwhile, your PF corpus grows faster. After 20 years, this extra Rs 12,000 annual contribution (plus employer match and interest) adds lakhs to your retirement fund.

For a Rs 7 lakh CTC employee whose basic was 40 percent earlier:

- Old PF: Rs 33,600/year

- New PF: Rs 42,000/year

- Monthly take-home drops by Rs 500 to 800

For Rs 15 lakh CTC:

- Old basic Rs 6 lakh → New at least Rs 7.5 lakh

- PF rise: Rs 18,000/year

- Gratuity for 10 years service jumps from about Rs 2.88 lakh to Rs 3.60 lakh or more

Moreover, gratuity for a Rs 20 lakh CTC employee with 15 years service could easily cross Rs 15 to 20 lakh instead of Rs 10 to 12 lakh earlier.

Furthermore, Who Gets Hit the Hardest and Who Benefits Most?

Employees whose current basic pay sits below 50 percent of CTC face the biggest restructuring. This group includes many in IT, consulting, and private sectors where allowances were high.

Lower salary brackets (under Rs 15,000/month) see the sharpest monthly drop because no PF cap applies.

On the positive side, everyone gains bigger gratuity and PF. Long-tenure employees benefit enormously upon retirement or job change.

Additionally, fixed-term and contract workers now enjoy gratuity sooner. Gig and platform workers gain new social security access.

What Should You Do Right Now to Protect Your Finances?

First, check your latest offer letter or payslip. Calculate your current basic as a percentage of CTC. Next, talk to your HR about the upcoming restructure. Ask if they plan to increase CTC or adjust allowances.

Furthermore, negotiate during appraisals. Highlight that higher PF also means higher employer cost—push for a CTC hike to maintain take-home. Moreover, start planning your budget for a possible 5 to 15 percent monthly dip initially. Use the extra PF as forced savings, you can withdraw partially for emergencies. Additionally, use online PF and gratuity calculators with the new 50 percent basic to estimate your future benefits.

Finally, remember this change protects your future self. The government designs it to stop companies from short-changing retirement benefits. While your wallet feels lighter today, it grows heavier tomorrow. The new labour codes mark a shift toward stronger social security for India’s workforce. Yes, take-home may drop slightly for now. However, PF and gratuity truly skyrocket, giving you real financial security in your later years. Furthermore, stay informed, ask questions at work, and embrace the long-term win.